On March 23, the first lecture of Amber Financial’s 2024 Tax Season Series, “Understanding Canadian Personal Taxation,” was passionately launched. The event featured Mr. James Wu, a former Senior Tax Manager at KPMG, who provided a thorough yet accessible presentation on the most recent updates on Canadian personal taxation, an introduction to income taxes in Canada, tax deductions and credits, updates from the Canada Revenue Agency, and a question-and-answer session with personal case studies. The lecture was filled with practical, easy-to-understand information.

Lecture Recap: Before delving into tax brackets and rates, it’s crucial to comprehend the structure of Canadian personal income tax, which comprises federal and provincial taxes. Individual taxable income in Canada is subject to a progressive tax rate system, meaning different income levels are taxed at different rates. Each year, the federal and provincial governments slightly adjust the income brackets and rates. Additionally, both levels of government have established a personal exemption amount.

The new federal tax rates for 2023 and 2024 are as follows:

The current personal income tax rates for British Columbia (BC) are:

Important Tax Filing Deadlines for 2023:

- The deadline for Canadian personal tax returns is April 30, 2024 (Tuesday).

- The personal tax filing deadline for self-employed individuals is June 15.

- The tax payment deadline for self-employed individuals is April 30.

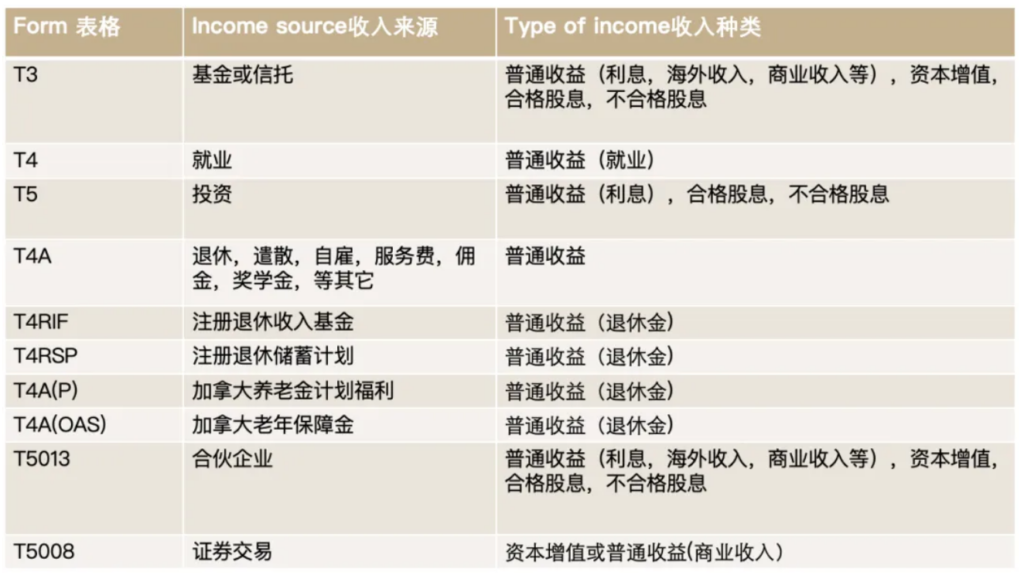

Common Income Tax Forms:

Common Tax Credits:

TFSA Limit: The contribution limit for the Tax-Free Savings Account (TFSA) in 2023 will surpass the $6,000 mark for the fourth consecutive year from 2019 to 2022, rising to $6,500. Based on inflation rates and the indexation used by the CRA, the limit for 2024 will increase to $7,000. If someone has been residing in Canada since 2009, is over 18 years old, and has never contributed to a TFSA, their cumulative contribution room would be $95,000 (including the contribution for 2024). Maximizing these limits allows for significant leveraging of funds in these accounts due to their unique tax-exempt nature.

RRSP Limit: The maximum contribution limit for the Registered Retirement Savings Plan (RRSP) in 2023 is $30,780, up from $29,210 in 2022. The contribution amount to an RRSP is capped at 18% of your 2023 income, including employment and rental income, minus any pension adjustments, up to the current annual limit. Beyond aiding in the accumulation of retirement savings, RRSPs serve as an effective tool for reducing tax brackets for middle and high-income earners. Funds from RRSPs can also be utilized for purchasing one’s first home and for continuing education. Anbang MIC also provides investment opportunities in RRSPs and TFSAs.

Guest Speaker Introduction: James Wu, CPA, CA, MPAcc (Chartered Professional Accountant, Master of Professional Accounting)

- Senior Manager, Tax at KPMG for 8.5 years

- Currently, Tax Manager at a public company for 2 years

- Director at JW Radiant Consulting Inc.

The 2024 updates and changes to Canadian personal tax filings reflect the ongoing trends in economic and social development, aimed at offering taxpayers more convenience and benefits. As a tax resident, staying informed about the latest information not only aids in legal tax avoidance but also enhances your tax knowledge. We hope this special Amber tax season event makes your personal tax filing this year smoother. We look forward to seeing you at Amber’s next vibrant event!