The Central Bank raised key interest rate by 0.75% on September 7 2022. The policy rate is now 3.25%. This is the fifth increase in 2022 since March. Total increase was 3% within 6 months in 2022. Central Bank carries out monetary policy by influencing short-term interest rates. It does this by adjusting the target for the overnight rate on eight fixed dates each year. The dates are as follows:

Oct 26 2022

Dec 7 2022

Jan 25 2023

Mar 8 2023

Apr 12 2023

Jul 12 2023

Sep 6 2023

Oct 5 2023

Dec 6 2023

There are two rate adjustment dates left in 2022 that could see a rate change. The Bank of Canada’s Sept. 7 announcement said “the Board of Governors is still judging whether interest rates need to be raised further given the outlook for inflation.” Industry experts hold different views on how much interest rates will change by the end of 2022.

Beata Caranci, Chief Economist at TD Bank, said the Bank of Canada said it believes more action is needed to reduce inflation and predicted the Bank of Canada would raise rates to 4%.

Josh Nye, the Senior Economist at Royal Bank of Canada, said the Bank of Canada’s statement suggests the Bank of Canada is pushing back against “calls for a pause in rate hikes” after September’s hike. He predicted another 0.25 % rate hike in October, with rates peaking at 3.5 % in 2022.

Benjamin Reitzes, Managing Director of BMO Capital Markets, said the tone of the Bank of Canada’s statement showed it remains “very concerned” about rising inflation, and he said there is no doubt that further rate hikes are coming, but the magnitude of the hike will be based on upcoming data.

Interest rates are rising, and if your current mortgage is a variable rate mortgage, your loan may soon reach a trigger point. This means:

1.) you may have to increase your monthly payments to keep the same amortization period, or

2.) you may have to pay off partial principal to keep the same monthly payment, or

3.) convert to a fixed-rate mortgage.

Hopefully, inflation will soon fall and the rate hike cycle will soon be over.

Amber Financial is Canada’s property lending specialist. Since our inception in 2015, we have successfully lent over $400 million in loans. We primarily offer residential, land, and commercial property loans. In residential lending, we offer two types of services.

First, Amber Financial acts as a home loan broker. Our lending team has years of experience in home loans and has an in-depth understanding of the terms of every financial institution in the market, including large banks, credit unions, and small banks. We can help you find the best loan package.

Second, Amber Financial offers loans directly. Another aspect of Amber Financial’s identity is that of a “home loan investment company”. We pool investors’ money to invest in real estate loans. Most of our clients are not served by banks. These include new immigrants with no work history or credit history, overseas buyers, those who cannot provide sufficient proof of income, and those who need a quick loan.

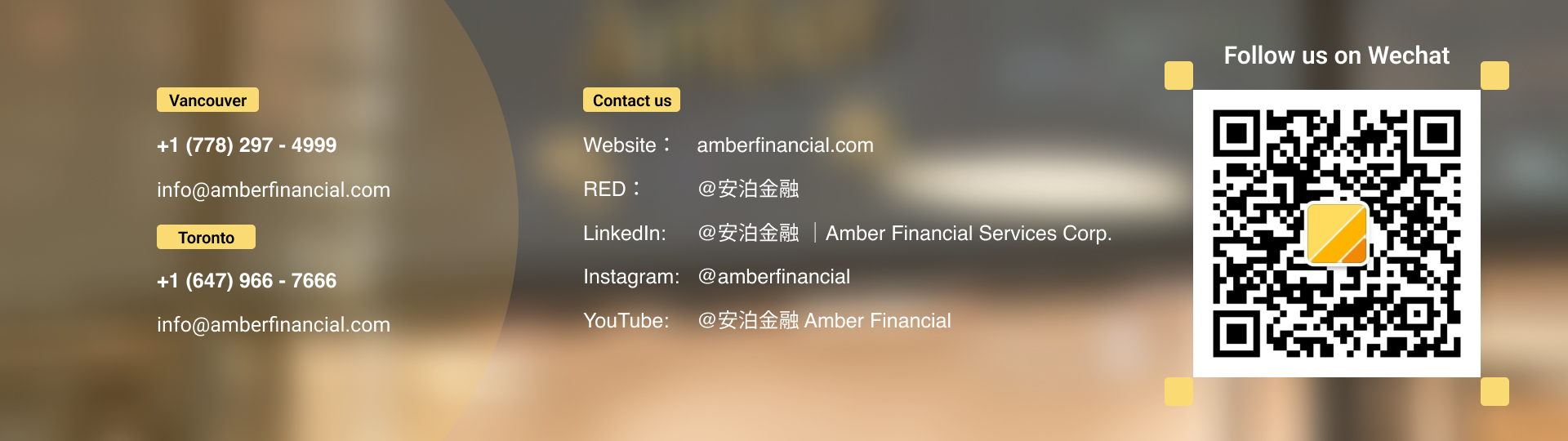

Our services are available in BC and Ontario. If you have any property loan needs, please feel free to contact us!