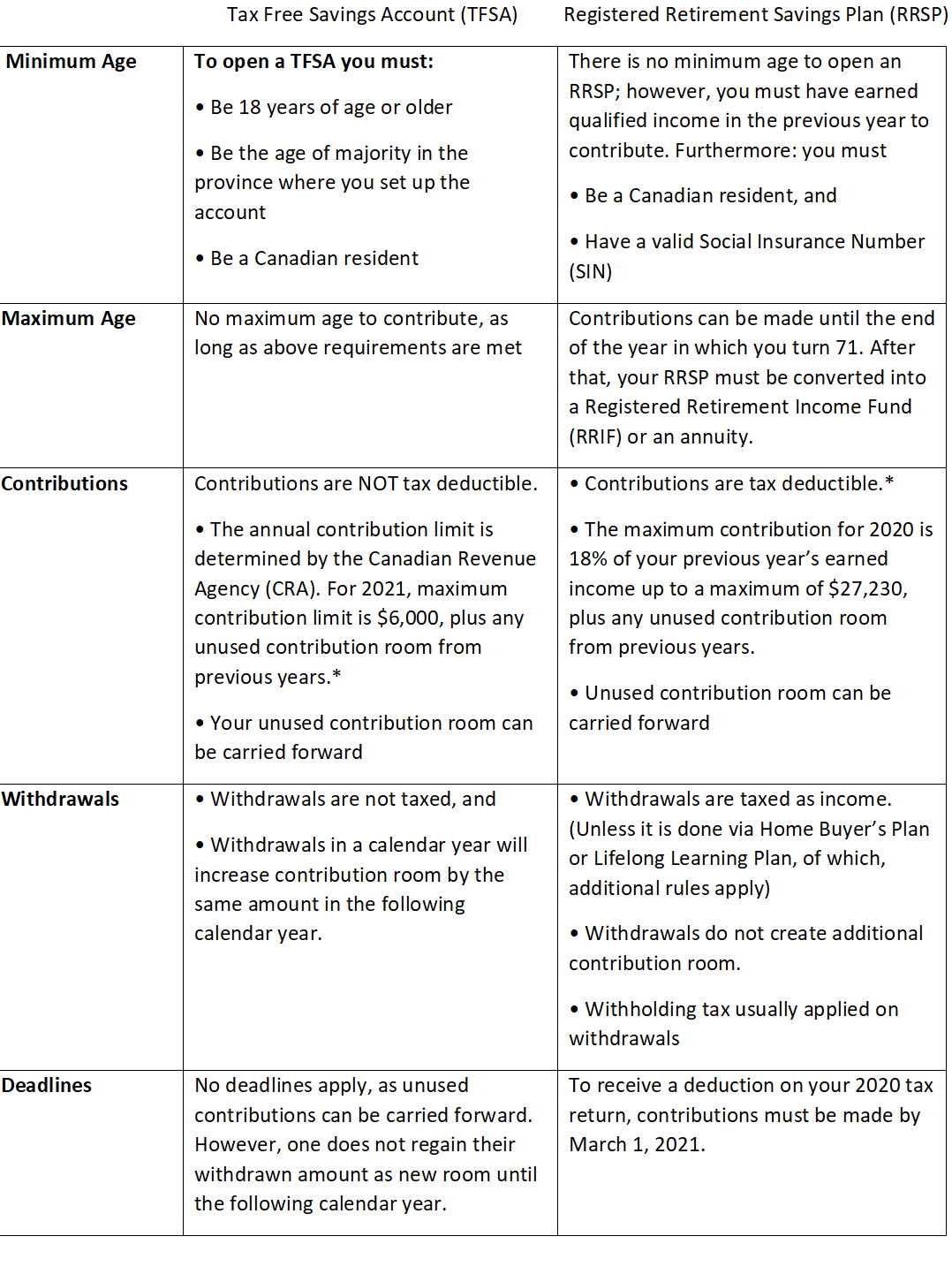

As the 2020 RRSP deadline is coming up soon, the table below can help explain the differences between your TFSA and RRSP, and the advantages of each:

In summary, TFSA is after-tax income that is contributed, and growth is totally tax free. RRSP is tax deferred, meaning tax is deducted at the time of contribution, while taxed as income upon withdrawal. Speak with our investment team to discuss the best options to plan for your portfolio.